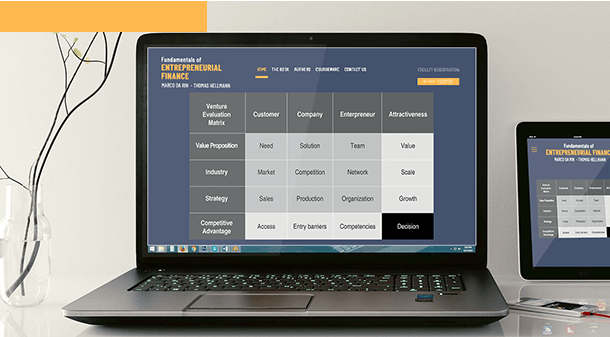

Courseware

In this section we provide many practical tools to help book readers to move from concept to practical application. We created these tools to help readers practice the notions explained in the book and use them for analysing real situations. Such practice will help readers to learn making effective decisions as entrepreneurs or investors.

We present the materials by chapter, and we plan to include additional tools over time. Faculty registered with us will get yearly notification of these additions.

The WorkHorse Inc. story.

We illustrate the main concepts and techniques with the use of a fictional example: WorkHorse Inc. We use a fictional example because it enables us to illustrate a maximum number of pedagogical points. At the same time, we built WorkHorse as a very realistic story that exemplifies the actual experiences of many entrepreneurial companies. Through WorkHorse we can provide a wealth of tools that directly bring the reader into applying techniques and understanding the complexity of entrepreneurial decision-making.

Chapter 1: Introduction to Entrepreneurial Finance

No materials

Chapter 2: Evaluating Venture Opportunities

This spreadsheet allows to analyze the nine cells of the VEM in a synthetic and synoptic way.

Venture Evaluation Matrix: Due diligence

This spreadsheet allows to guide work on due diligence on an entrepreneurial venture by selecting appropriate actions for each of the nine cells of the VEM.

Venture Evaluation Matrix: Drawing conclusions

This spreadsheet allows to bring the analysis of the nine cells of the VEM to conclusion, by deriving the attractiveness and competitive advantages of a venture.

The Venture Evaluation Matrix Spreadsheet Tool

This tool allows to visualize the results of a VEM analysis in a practical way. It is based on the VEM spreadsheet but also requires users to assign a numerical score to each VEM cell, and to choose their own weight for each cell. This yields a summary ‘grade’ that can be used to compare or rank ventures. The VEM scores can also be represented graphically in a radar chart that allows to intuitively grasp the assessment of the venture. The Tool is set up so that users can easily add more questions or modify the existing questions for each cell of the VEM. Users can thus customize the spreadsheet tool to their own specific needs. The VEM Spreadsheet Tool is accompanied by an instruction sheet.

Chapter 3: The Financial Plan

The Financial Projections Model (Blank)

This comprehensive spreadsheet allows to set up financial projections with a considerable degree of flexibility. It covers all three main accounts (P&L, BS, CF) and can be modified to make it suitable for different types of business. It also allows to vary the time frequency and to build financial ratios.

Financial Projections model (WorkHorse)

This comprehensive spreadsheet provides a complete set of financial projections for WorkHorse, Inc., which are also used in the book as a basis for the case vignettes.

Gantt chart

We provide a spreadsheet tool for building a Gantt chart for timing the development of the venture, identifying the key milestones, and planning fundraising. The chart is based on blocks that can be customized according to the venture’s nature, its stage of development, and the business context.

Chapter 4: Ownership and Returns

Mechanics of Ownership and Valuation

This tool allows to compute the various mechanical relationships between core components of the ownership and valuation variables, extending material explained in section 4.1 of the book.

This tool provides a comprehensive approach to build capitalization tables over multiple rounds in a very simple, yet very prices way. It is structured to include details on fundraising at the individual investor.

This tool expands on the material explained in section 4.2 of the book and allows to compute the three measures of investor returns (IRR, NPV, CCM) as well as the PME measure we introduce in chapter 12. The tool is structured so as to compute both single-round and multiple-round returns, and can be easily adapted and extended to include for additional investors, rounds, and cash flow patterns.

The Long Road to the Right Valuation

This tool builds on material explained in section 4.3 of the book. It provides a very simple way to compute how different valuation offers by different investors can be compared and ranked. The tool illustrates also the role of negotiation (explained in chapter 7) and of investor value adding (explained is chapter 8).

The Founder Allocation of Shares Tool (FAST) reflects the analysis of section 4.4.3 of the book. It makes operational the agreement between founders, based on the assumptions and reasoning developed in the book. These are translated into a simple spreadsheet that derives a share allocation starting from the chosen assumptions. The relevance of each criterion can be modified, and a different number of founders, with different preferences, can also be incorporated.

Chapter 5: Valuation Methods

This tool is built to value a start-up using the VC Model developed in section 5.2 of the book. under different assumption. It encompasses several variations of the baseline model, and it builds a valuation both for a single round and across multiple rounds.

This simple tool is handy to compute how a start-up’s failure risk affects valuation through the failure risk premium.

This tool is built to value a start-up using the DCF method developed in section 5.3 of the book. It is based on financial projections from chapter 3, and can be used to obtain different terminal value projections using different assumptions.

Valuation with Investment Comparables and Exit Comparables

This tool allows to value a start-up using comparable companies. It considers investment comparables, as analyized in section 5.4.1 of the book, and exit comparables, as analysed in section 5.4.2.

This tool provides a simple way for implementing comparables-based valuation, expanding on Box 5.3 in section 5.4.2 of the book.

This tool makes the “Probability of Exit” model we develop in section 5.5.2 of the book operational. This model incorporates explicitly the probability of different types of exit into consideration, providing a generalization of the Venture Capital Model.

Chapter 6: Term Sheets

This tool can be used to study the effects of preferred stock on the cash flows of entrepreneurs and investors, which we explain in section 6.2 of the book. It allows the analysis of plain convertible preferred, participating preferred, and capped participating preferred. The tool allows to modify several parameters to generate many possible situations and variations in the contract. It also allows to study the consequences of preferred stock on capitalization tables across rounds, building on materials we explain in section 4.1.4 of the book.

This tool provides an intuitive way to compare the effects on cash flow and ownership generated by different types of preferred stock. It exposes some common fallacies that we debunk in section 6.5 of the book.

This tool provides a simple way to understand the working of convertible notes that we explain in section 6.6. of the book. It includes the case of valuation caps.

Chapter 7: Structuring Deals

This tool provides an operational solution to assessing the fit between entrepreneur and investor. It is based on concepts developed in several chapters of the book, and its construction is developed in section 7.3. The tool can be easily modified along several dimensions to accommodate different approaches to entrepreneur/investor matching.

The instructions to the use of the MATCH tool provide a detailed guide to its practical implementation.

Chapter 8: Corporate Governance

This tool provides some simple relationships that make clear the role of dual class shares and other deviations from the one-share-one-vote principle that we explain in section 8.2.1 of the book.

Chapter 9: Staged Financing

This tool computes share ownership and dilution for entrepreneurs and investors across three rounds, building on materials we explain in section 9.2.1. It also ncludes the possibility of down rounds. The tool can be extended to different types of investors and different price dynamics.

This tool provides a valuation of a start-up done using real options, which we explain in section 9.2.2 of the book. The tool is particularly useful to learn about the feasibility of a proposed round and about how staging can make the deal more appealing to investors. The tool allows to change the underlying assumptions to address different business situations.

This tool allows to compare a tranched vs. a staged deal structure, building on material we explain in section 9.2.3 of the book.

This tool provides an analysis of how investor ownership changes over multiple rounds, so as to compute the investor’s retention rate that we explain in section 9.2.4. The tool encompasses three rounds and can be modified to include a different number of rounds and multiple investors with different cash flow rights.

This tool allows to explore the conflict of interests that arises in a new round when new investors arrive and old investors may choose whether or not to keep investing, and how much.

This tool allows to dig deep into the comparison of cash flows to different types of investors under different seniority rules for convertible preferred stock issued to investors in a round A and a round B situation. The tool allows for changing priorities and for adding additional rounds or investors. It expands on materials we explain in section 9.3.1 of the book.

Dilution with a Stock Option Pool

This tool allows to verify the effect of stock option pools on share ownership, building on section 9.3.3 of the book.

Anti Dilution Clauses

This tool allows to practice the calculations underlying the different types of anti-dilution clauses that we explain in section 9.3.2 of the book.

Anti Dilution Clauses in Practice

This tool allows to practice the calculations underlying the implementation in practice of different types of anti-dilution clauses, that we explain in section 9.3.2. of the book.

Chapter 10: Debt Financing

This tool provides a detailed analysis of the material we explain in section 10.2.1 of the book. The tool allows to compare different combinations of debt and equity and shows why entrepreneurs often fail to understand the true cost of debt. The tool can be further developed by incorporating alternative assumptions on equity funding.

The tool provides a handy way to compute the cost of trade credit as a function of time and discount rate, building on materials we explain in section 10.4.2.

This tool compares the cost and other features of different sources of non-equity finance, building on materials we explain in section 10.4 of the book.

This tool explores the valuation of start-up companies that raise debt as a source of funding. It builds on materials we explain in section 10.5 of the book.

Chapter 11: Exit

This comprehensive tool allows studying the implications of pricing and other IPO choices on the ownership and financial gains of entrepreneurs and investors. It builds on section 9.2 of the book and can be extended to include more clauses and investors with different funding contributions.

This tool allows to compare the share ownership implications for shareholders when some investors do a secondary sale to the case of an additional funding. It builds on materials explained in section 11.4.2.

This tool summarizes the whole financial outcomes for WorkHorse Inc., and can be adapted to be applied and adapted to different funding histories. It puts together the capitalization tables across the whole fundraising history of the company, and computes different measures of investor returns, explained in sections 4.2 and 11.6 of the book.

Chapter 12: Venture Capital

This tool allows a detailed analysis of the returns to LPs which invest in venture funds. It provides for a variety of assumptions and investment configurations, building on section 12.6 of the book.

Chapter 13: Early Stage Investors

No materials

Chapter 14: Ecosystems

No materials

New Materials

THE BOOK

THE AUTHORS

COURSEWARE

CONTACT US

FACULTY REGISTRATION

Fondamentals of Enterpreneurial Finance is published by Oxford University Press and written by Marco Da Rin and Thomas Hellmann. Contents available on this site are the propriety of Marco Da Rin and Thomas Hellmann. Partial or full reproduction is not permitted. Copyright © 2020